By continuing to use this site you consent to the use of cookies on your device as described in our Cookie Policy. You can change your Cookie Settings at any time but parts of our site will not function correctly without them.

A plan that helps you save during your lifetime and provide your family with a whole life cover in the event of your unfortunate demise.

Create a legacy for your family

Save for your child's education and your retirement

Choose to stay protected for your whole life

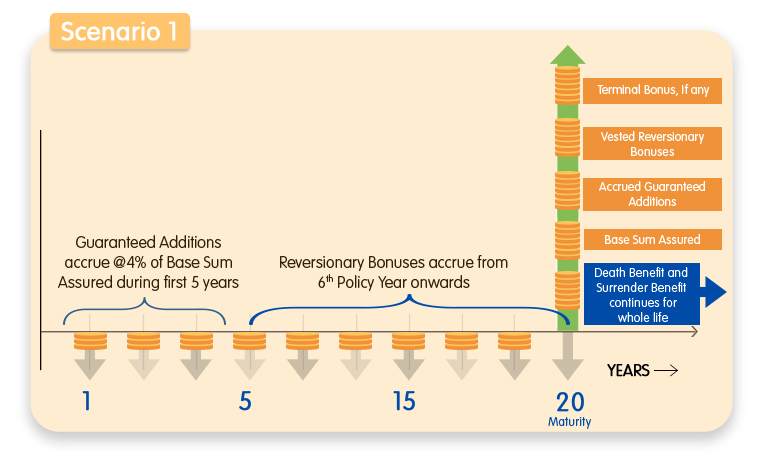

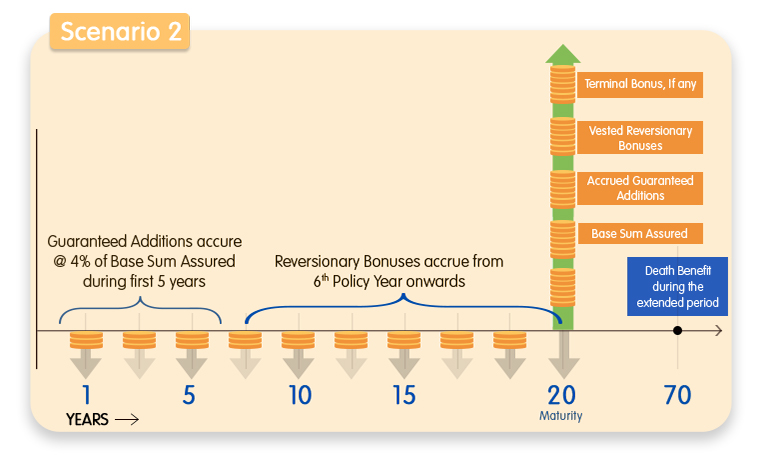

Enhance your savings through bonus additions

Flexible Cover options:

Savings with the comfort of guarantees:

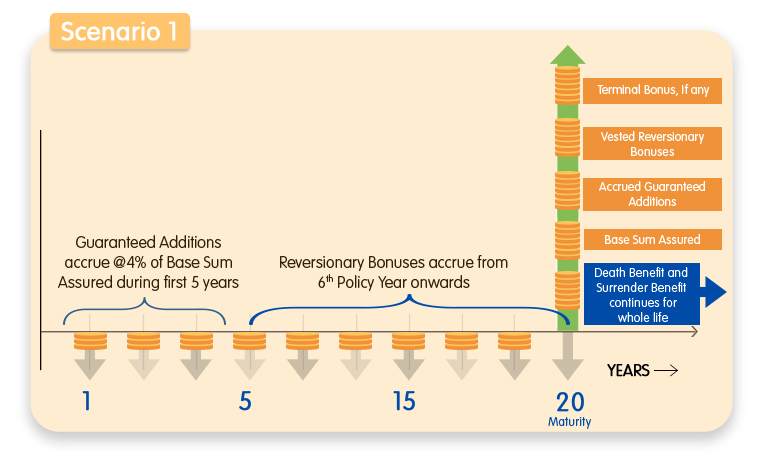

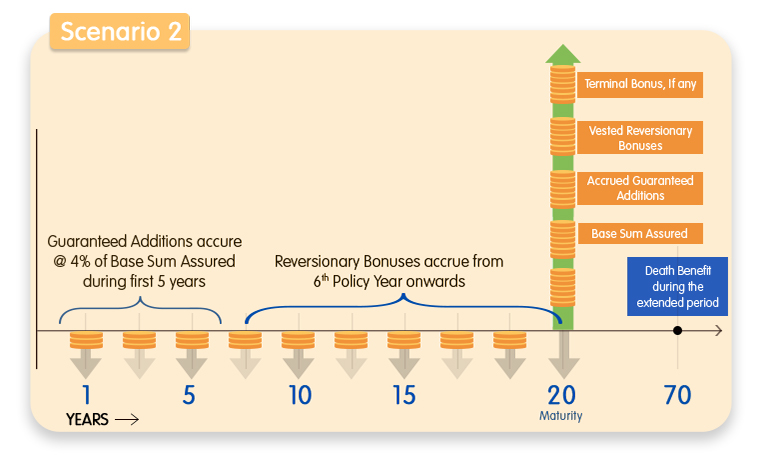

At the end of the Policy Term, receive:

Pay as you like:

Liquidity:

Tax benefits: