Give your family the financial security they deserve

5-year delay will cost you - 39% * more

5-year delay will cost you - 39% * more  Cover yourself for whole life ^

Cover yourself for whole life ^ Life cover that grows every year +

Life cover that grows every year + Cover your large responsibilities with you policy

Cover your large responsibilities with you policy It's an insurance policy, not a loan

It's an insurance policy, not a loan

Reliance Digi Term Insurance Plan

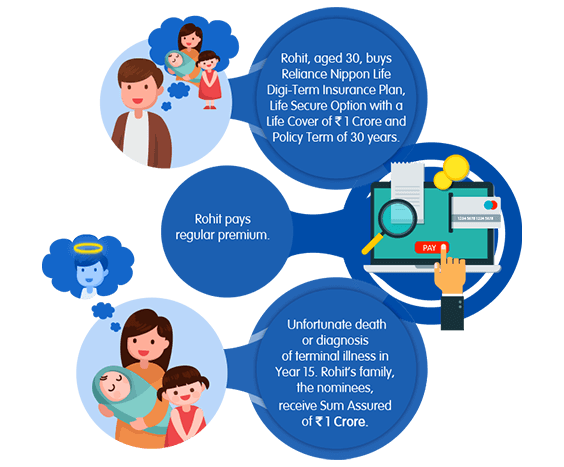

Life Secure

Under this option, a lump sum benefit equal to Sum Assured on Death is payable, on the earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

EventOn Death / Diagnosis of Terminal Illness

BenefitSum Assured on Death is paid as a lump sum benefit

Enhanced Life Secure

Under this option, your life cover increases by a simple rate of 5% p.a. at each policy anniversary subject to a maximum increase of 100% of Base Sum Assured chosen at inception.

A lump sum benefit equal to Sum Assured on Death is payable, on the earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

On Death / Diagnosis of Terminal Illness

BenefitSum Assured on Death is paid as a lump sum benefit

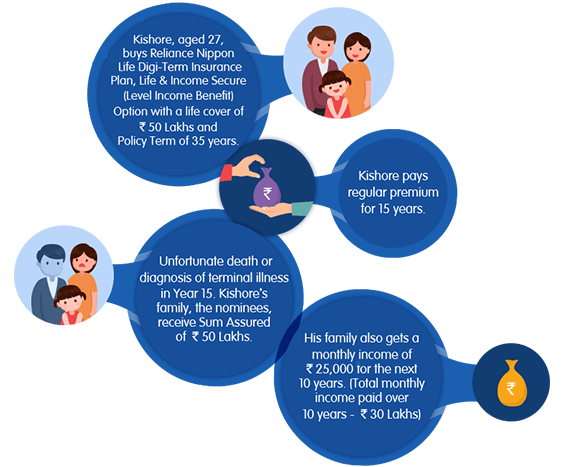

Life & Income Secure (Level Income Benefit)

Under this option, a lump sum benefit equal to Sum Assured on Death, plus a monthly income for a period of 10 years is payable on the earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

EventOn Death / Diagnosis of Terminal Illness

BenefitSum Assured on Death is paid as a lump sum benefit plus

Level monthly income of 0.5% of Base Sum Assured for 10 years

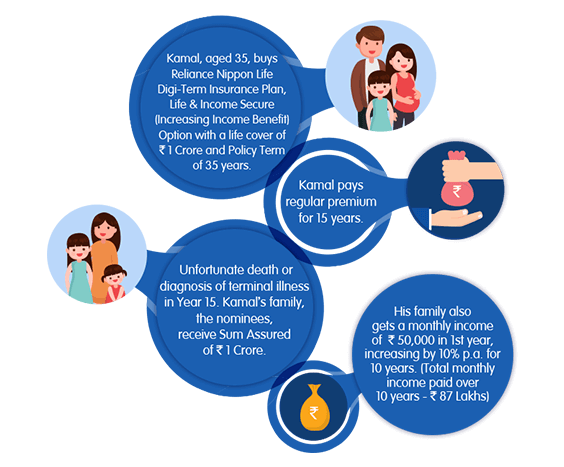

Life & Income Secure (Increasing Income Benefit)

Under this option, a lump sum benefit equal to Sum Assured on Death, plus a monthly income of 0.5% of the Base Sum Assured, increasing at a simple rate of 10% p.a., for a period of 10 years is payable on the earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

EventOn Death / Diagnosis of Terminal Illness

BenefitSum Assured on Death is paid as a lump sum benefit plus

Increasing monthly income of 0.5% of Base Sum Assured increasing 10% p.a. for 10 years

His family also gets a monthly income of ₹ 50,000 in 1st year, increasing by 10% p.a. for 10 years. (Total monthly income paid over 10 years - ₹ 87 Lakhs)

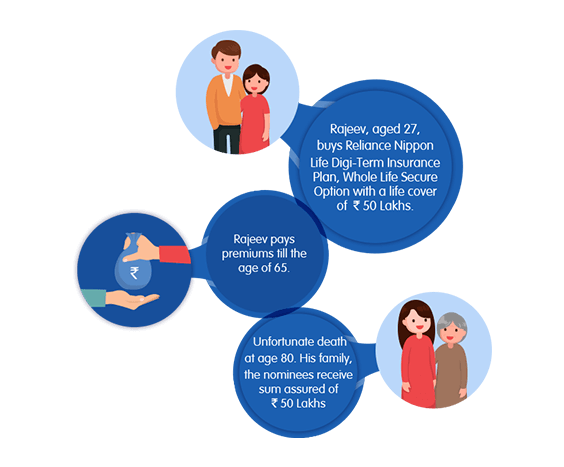

Whole Life Secure

Under this option, you are insured for Whole of Life. A lump sum benefit equal to the Sum Assured on Death is payable, on the earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

EventOn Death / Diagnosis of Terminal Illness

BenefitSum Assured on Death is paid as a lump sum benefit

* Comparison between case 1: Life Secure - SA - 1 Cr., PT - 30 years, Male, Non-smoker, Age 30 years (Premium - Rs. 8,900) and case 2: Life Secure - SA - 1 Cr., PT - 30 years, Male, Non-smoker, Age 35 years (Premium - Rs. 12,393). Premiums are exclusive of applicable taxes and levies.

^ Available only under Whole Life Secure option

+ Available only under Enhanced Life Secure Option

What are term plans?

- Term Plans help you financially secure your family’s future in case of uncertainties like death, disability and disease, at a fixed premium rate for a fixed period. Term policies are much less expensive than your traditional insurance plans and allow you to take a high coverage at affordable premiums.

- The Digi-Term Insurance plan provides comprehensive coverage against major life risks of death and terminal illness. This unique Terminal Illness Benefit is premised on paying the sum assured to the policyholder in case of diagnosis of any terminal illness which can be used for either seeking alternate treatment and/or planning the legacy for survivors. This benefit is embedded into the product at no extra cost to customers. You can further enhance your coverage to eventualities such as accidental death, total and permanent disability, and diagnosis of a critical illness using our range of riders.

- The nominee of the insured life gets the total pay-out in case of either untimely death or diagnosis of terminal illness in the life insured during the policy term. This benefit can be paid out as a lump sum pay out or a combination of lump sum and monthly pay out.

Term insurance is affordable

There is no investment component in term plans; this is a pure insurance product

There is no investment component in term plans; this is a pure insurance product  Online purchase of the term insurance plan will save you lot of money on administration and other charges

Online purchase of the term insurance plan will save you lot of money on administration and other charges  For a cover of 10 times of your annual income, you just pay annually a sum of 1-2% of your annual income

For a cover of 10 times of your annual income, you just pay annually a sum of 1-2% of your annual income 0 %

0 Days

Rs. 0 Cr/-

0

Buying the term plan later will be costlier than you think

-

adjust

Cost of deferment -

adjust

You remain vulnerable -

adjust

Financial Burden of Competing Expenditures

Additionally, as you grow older, health conditions might change from the late 30's to 40s.There could be onset of lifestyle diseases, which could mean you are charged higher premiums or in some cases, even rejection of the policy.

Frequently Asked Questions (FAQ)

-

There are 5 plan options available with Reliance Digi Term Insurance Plan :

-

Life Secure: Sum Assured on Death shall be payable in lump sum on earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

-

Enhanced Life Secure: Sum Assured on Death shall be payable in lump sum on earlier of death or diagnosis of Terminal Illness, provided the Policy is in force. In this plan option, your life cover increases by a simple rate of 5% p.a. at each policy anniversary subject to a maximum increase of 100% of Base Sum Assured chosen at inception

-

Life & Income Secure (Level Income Benefit): Sum Assured on Death shall be payable in lump sum plus a monthly income benefit for a period of 10 years shall be payable on earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

Under this option, monthly income shall be 0.5% of Base Sum Assured and is payable for 10 years.

-

Life & Income Secure (Increasing Income Benefit): Sum Assured on Death shall be payable in lump sum plus a monthly income benefit for a period of 10 years shall be payable on earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

Under this option, monthly income shall be 0.5% of Base Sum Assured, it will increase at a simple rate of 10% p.a. and shall be payable for 10 years.

-

Whole life Secure: Under this option, Sum Assured on Death shall be payable in lump sum on earlier of policyholder’s death or diagnosis of terminal illness and the policy shall terminate.

-

Life Secure: Sum Assured on Death shall be payable in lump sum on earlier of death or diagnosis of Terminal Illness during the Policy Term, provided the Policy is in force.

-

Life Assured shall be regarded as terminally ill only if that Life Assured is diagnosed as suffering from a condition which, in the opinion of two independent medical practitioners’ specializing in treatment of such illness, is highly likely to lead to death within 12 months.

The terminal illness must be diagnosed and confirmed by medical practitioners registered with the Indian Medical Association and approved by the Company. The Company reserves the right for independent assessment. -

You can choose to be covered for any term from 15 to 40 years subject to meeting the maximum maturity age. For Whole Life Secure Option, you will be covered for the whole of life.

-

You can choose to pay from the following premium paying options available with this plan:

- Regular pay (For all options except Whole Life Secure) - You pay premiums throughout the chosen policy term

- Limited pay (For Whole Life Secure) – Under this option, you pay premiums until the attainment of 65 years of age.

-

Anyone between the age of 18 to 60 (25 to 60 for Whole Life Secure Option) can buy this plan.

-

Premiums can be paid on a Yearly, Half-Yearly, Quarterly or Monthly basis.

-

To safeguard yourself and your family members against certain unfortunate events, we offer the following riders with this plan at a nominal cost.

- Reliance Nippon Life Accidental Death Rider

- Reliance Nippon Life Accidental Death and Disability Rider

- Reliance Nippon Life Accidental Death and Disability Plus Rider

Only one of the above three accidental riders can be attached with the base policy at any point in time.

Reliance Nippon Life Critical Illness Rider.

For further details on all the conditions, exclusions related to the insurance riders, please read the rider terms and conditions and rider sales brochure carefully or contact your insurance advisor. -

Benefit on death or diagnosis of terminal illness is applicable as per the plan option chosen:

Plan Option Death Benefit or Diagnosis of Terminal Illness Life Secure

Enhanced Life Secure

Whole Life SecureSum Assured on Death Life & Income Secure (Level Income Benefit) 1. Sum Assured on Death; plus

2. Level monthly income of 0.5% of Base Sum Assured shall be payable for 10 yearsLife & Income Secure (Increasing Income Benefit) 1. Sum Assured on Death; plus

2. Increasing monthly income of 0.5% of Base Sum Assured increasing at simple rate of 10% p.a. shall be payable for 10 years.

For more details, please refer the product brochure. -

Sum Assured on Death is higher of –

(i) 10 times of Annualised Premium

(ii) Guaranteed Sum Assured on Maturity

(iii) Absolute Amount Assured to be paid on Death

Where “Absolute Amount Assured to be paid on Death” is equal to Base Sum Assured for all plan options except for Enhanced Life Secure plan option.

For Enhanced Life Secure plan option, “Absolute Amount Assured to be paid on Death” is equal to Base Sum Assured increased by simple rate of 5% p.a. at each policy anniversary subject to maximum increase of 100% of Base Sum Assured chosen at inception. -

As you prosper in life, your life should be adequately protected to take care of your loved ones in your absence. Under this feature you have the following options:

A. Increase your Sum Assured: - This feature enables you to increase your Sum Assured at important stages of your life (marriage, birth/adoption of child), without any underwriting.

Your Sum Assured can be increased on any one or all of the following events provided the Life Assured is less than 45 years of age at the time of below mentioned events –

Event Additional Sum Assured (% of original Base Sum Assured) Maximum Additional Sum Assured allowed Marriage (first marriage only) 50% Rs. 50,00,000 Birth/Legal adoption of 1st child 25% Rs. 25,00,000 Birth/Legal adoption of 2nd child 25% Rs. 25,00,000

B. Reduce Additional Sum Assured: On reaching a stable position in your life where you have achieved substantial assets that you feel would take care of your loved ones in future, you can choose to reduce your Sum Assured in future to the extent of the Sum Assured increased under Life Stage Benefit. You can avail this option once you have reached the age of 45 years. -

There is no loan facility available under this plan.

-

Surrender Value is applicable only for and Whole Life Secure plan option.

The policy shall acquire a Surrender Value:- For Premium Payment Term less than 10 years: If premiums have been paid in full for at least the first two consecutive years

- For Premium Payment Term greater than or equal to 10 years: If premiums have been paid in full for at least the first three consecutive years

For more details on surrender benefit, please refer the product brochure. -

If you discontinue the payment of premiums before your Policy has acquired a Surrender Value, your Policy will lapse at the end of the grace period and the Death Benefit and rider benefits, if any, will cease immediately and no benefits will be paid when the Policy is in lapsed status.

If the Policy has acquired a Surrender Value and no future premiums are paid, you may choose to continue your Policy on Paid-up basis. For a Paid-up Policy, the benefits under the plan will be reduced

For more details on benefits under paid-up policy, please refer the product brochure. -

You can revive your lapsed/paid-up policy and the riders for its full coverage within five years from the due date of the first unpaid premium but before policy maturity, by paying all outstanding premiums together with the interest, as applicable.

-

Premiums paid under Reliance Nippon Life Digi-Term Insurance Plan and rider(s) opted for, if any, are eligible for tax exemptions, subject to the applicable tax laws and conditions

-

In the event, you disagree with any of the terms and conditions of this policy, you may cancel this policy by returning the Policy Document to the Company within 30 days of receiving it, subject to stating your objections. The Company will refund the premiums paid by you less a deduction of the proportionate risk premium for the time that the Company has provided you life cover up to the date of cancellation and for the expenses incurred by the Company on medical examination and stamp duty charges.

-

Nomination is allowed as per Section 39 of the Insurance Act, 1938, as amended from time to time. Assignment is allowed under this plan as per Section 38 of the Insurance Act, 1938, as amended from time to time.